The 2018 Michelin Suppliers Awards ceremony took place on October 25, at the “Adventure Michelin” in Clermont-Ferrand, France, where Michelin headquartered.

Himile was selected as one of the five best suppliers from over 60,000 companies, and it was the only company from Asia presented, being the first Chinese company awarded by Michelin.

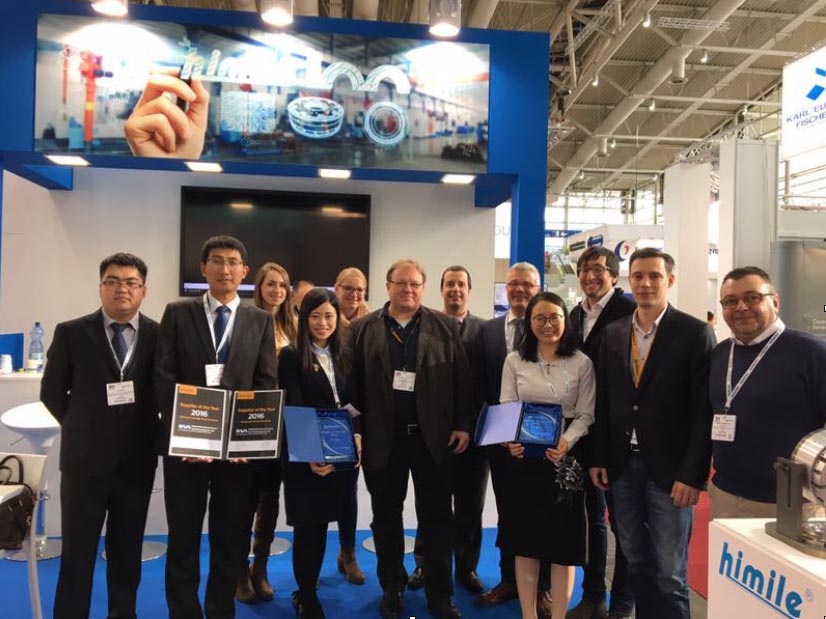

Jean-Dominique Senard, CEO of the Michelin Group (middle in the second row), Michelin executives, and representatives of the awarded suppliers

Five Best Suppliers

In the field of Raw Materials Purchasing:

BEKAERT: Founded in 1880, the Belgium-based company is a global market leader in the field of steel wire transformation and coating technologies.

SOLVAY: Also based in Belgium, and created in 1863, Solvay is a world leader in the chemicals industry.

In the field of Industrial Purchasing:

HIMILE: Established in 1995, this Chinese company has become an international player in three major areas, namely tire mold machines, high-end mechanical parts, and equipment for the oil and gas industries.

VMI: This Dutch company was born in 1945 and is the leader of tire building machinery and rubber cutting machinery.

In the field of Services Purchasing:

Human Technologies Inc (HTI): Founded in 1999, HTI has emerged as one of the biggest recruitment and human resources companies in the southeast of the USA.

Award presented to Himile by member of Michelin Executive Committee and Director of R&D Department

Award Ceremony

Ms Hélène, Purchasing Director (Lady on the right)

Speech Phrase

Dominique CORDAILLAT, Vice President of Group Industrial Purchasing addressed the award speech to Himile. He highly appraised Himile’s excellence in matching Michelin’s standards for a best supplier and stated the following reasons for presenting Himile such an award:

Customer-oriented. Always quick response and active actions to customer’s needs, no request was too big or too small. Every Michelin employee who works with Himile marvels at Himile’s customer centralization.

Excellent product quality. Good and stable product quality as always, wining trust from Michelin. Almost 100% delivery on time. Himile presents an impressive commitment, and it is capable to meet customer’s special delivery requirement, providing Michelin flexibility in purchasing.

Innovation leads to development. Himile’s study on new magnesium alloy and new solution for surface treatment by laser are valuable for Michelin.

Strong commitment to society. Photovoltaic power generation has been widely used in Himile to replace power generation by coal. Under China’s context of environment protection, Himile has taken multiple actions to contribute to the sustainable development. Himile establishes schools, hospital and cares about employees’ individual development, which highly accord with Michelin’s ideas and practice.

Award Medal: Model of VISION, the Michelin Concept Tire.With the VISION concept, a customized, rechargeable, adaptable and ecological tire, MICHELIN offers a mobility solution that combines the tire with brand new services. It is manufactured with advanced material and by 3D printing technology. VISION is the translation of Michelin’s 4R strategy (Reduce, Reuse, Recycle and Renew)

David Zhang, Himile Vice President & Member of the Board interviewed after ceremony.

About Michelin

Michelin was founded in 1889. As the leading tire company, it is dedicated to enhancing its clients’ mobility, sustainably; designing and distributing the most suitable tires, services and solutions for its clients’ needs; providing digital services, maps and guides to help enrich trips and travels and make them unique experiences; and developing high-technology materials that serve the mobility industry.

Michelin is present in 171 countries, has more than 114,000 employees and operates 70 production facilities in 17 countries which together produced around 190 million tires in 2017.